If you’re buying a home in Ohio, especially if you’re a first-time buyer or relocating, this is the moment where confidence matters most: the purchase contract.

And let me say this the way I say it to my clients: you don’t need to be a legal expert to protect yourself, you need clarity. You’re allowed to ask questions. You’re allowed to slow it down. And you deserve to understand every page before you sign.

This guide is based on my YouTube video, where I walk through the Ohio real estate purchase contract step-by-step. Still, I’m also adding 2026 updates, buyer-friendly checklists, and trusted resources so you can feel informed, not overwhelmed.

Watch the video first (then use this blog as your checklist)

If you want the “quick walkthrough” version, watch the video here and then come back to this guide:

What Is a Real Estate Purchase Contract in Ohio?

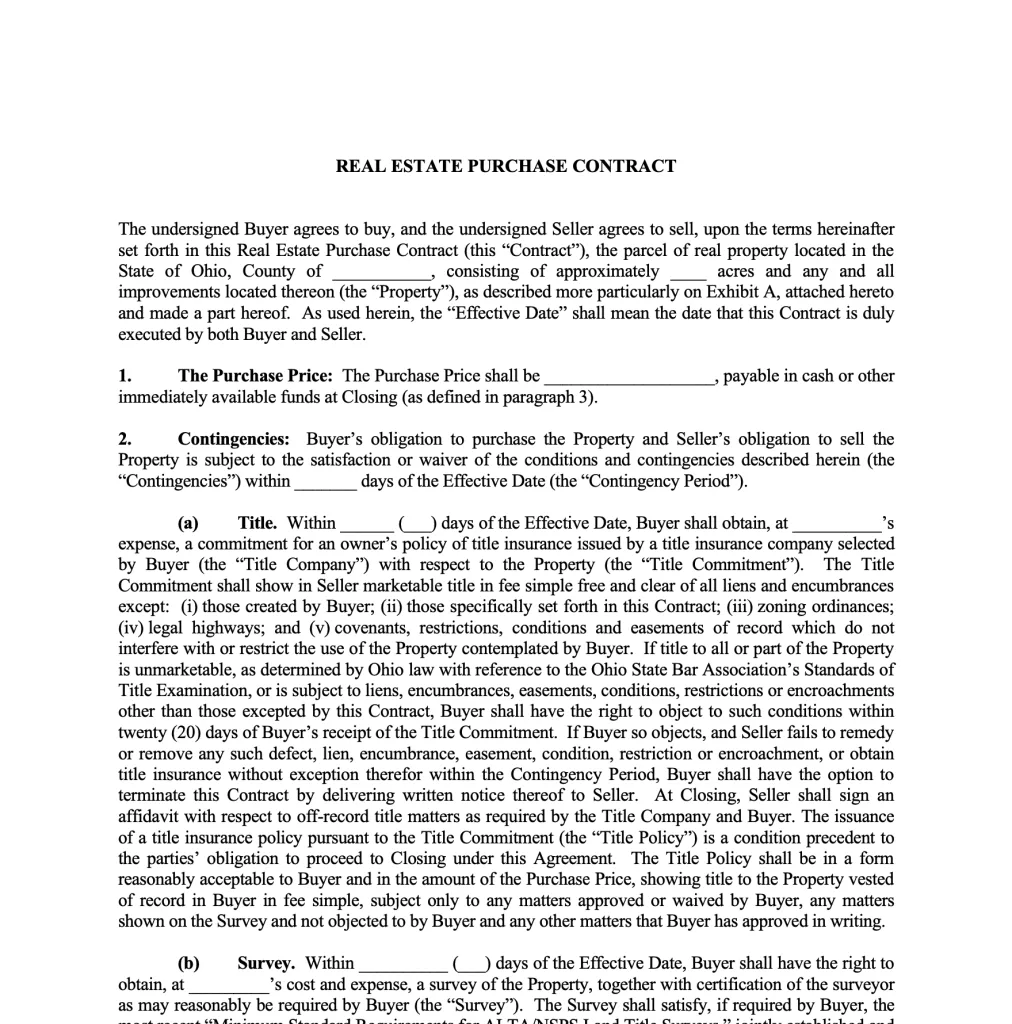

An Ohio real estate purchase contract (often called the Ohio purchase agreement) is the document that turns a “yes, I want this home” into a legally binding deal.

It typically covers:

- the price you’re paying,

- your deposit (earnest money),

- your financing terms,

- inspections,

- appraisal protection,

- what stays with the home,

- the closing date,

- and when you get possession.

Ohio REALTORS’ consumer guidance highlights many of these same deal points, price, items included, financing terms, earnest money, closing/possession timing, and inspection provisions.

Quick Ohio reality check: In many parts of the U.S., closings can involve attorneys more directly. In Ohio, closings are commonly handled through title services/closing agents, and the fees for closing services often show up within “title services” on your paperwork.

Sample Ohio purchase agreement page for educational purposes, always review your own contract details before signing.

Key Sections of the Ohio Purchase Agreement (2026 Update)

Purchase Price & Earnest Money

Purchase price is obvious. Earnest money is where buyers get surprised.

Earnest money is a good-faith deposit that signals you’re serious. It’s usually held in escrow and can be applied toward your purchase at closing, but you may risk it if you breach the contract. Contingencies are one of the key ways buyers protect that deposit.

Monika tip: Earnest money is not about “proving yourself.” It’s about structure and protection. We write offers that keep you safe and competitive.

Financing Contingency (VA, FHA, Conventional, Cash)

Your financing contingency is your “this only works if…” clause.

When we write a contract, I want your terms to reflect your real situation, not your wishful situation. In my video, I say it plainly: don’t write financing terms you can’t meet. Write the contract for the worst-case scenario, and improve later if you can.

If you’re choosing between loan types, the CFPB breaks down how loan types differ and what to consider (including conventional vs government programs).

Common buyer examples (simple):

- Conventional: Often lower long-term costs than FHA, but can be stricter to qualify for.

- FHA / VA: May help buyers with different qualification needs (eligibility varies). (Use lender confirmation + local agent strategy.)

You don’t need to “sound rich” on paper. A strong offer is about clean terms, realistic deadlines, and smart protection, not pretending.

Inspection & Appraisal Contingencies

If there’s one thing I’ll repeat forever: don’t skip inspection.

Inspections help you uncover what you can’t see in a showing (structure, roof, sewer, radon, pests, depending on what you choose). This is where buyers avoid the “surprise repairs” that wreck budgets.

Appraisal contingency is your protection if the lender’s value comes in low. If appraisal is below the agreed price, you may renegotiate, bring cash, or exit, depending on what the contract says.

Inspections protect your future. Appraisals protect your investment. Skipping either is like buying a car without opening the hood.

Even gorgeous homes deserve an inspection. Protect your future, and your budget.

HOA Rules & Restrictions

If the home is in an HOA, you’re not just buying a property, you’re buying a rulebook.

The National Association of REALTORS encourages buyers to review HOA governing documents (CC&Rs, bylaws, rules/regulations) and also consider the HOA’s financial health because it can affect lending and quality of life.

HOA questions I want you asking:

- Can I build a fence?

- Can I park a camper/boat?

- Are rentals allowed (now or later)?

- Any age restrictions?

- Who does lawn/snow maintenance?

- What are dues and special assessments?

You don’t need to be “nice” about HOA rules. You need to be clear. Your home should fit your life, not the other way around.

Inclusions, Exclusions & Personal Property

This is where buyers get burned, fast.

If you want appliances or specific items, they should be written clearly. In the video, I call out appliances and personal items: fridge, washer/dryer, curtains, TVs, swingsets, spell it out.

Simple rule: If it matters to you, put it in writing.

Closing Timeline & Post-Occupancy

A “typical” closing timeline can be around 30 days, but real life varies.

Now here’s the spicy part: post-occupancy (when the seller stays after closing) can be convenient, but it increases risk for buyers.

If a seller asks for post-occupancy, think like a CEO:

- What’s the rent/payment for those days?

- What’s the security deposit/escrow?

- Who pays utilities?

- What happens if damage occurs?

- What’s the penalty if they don’t leave on time?

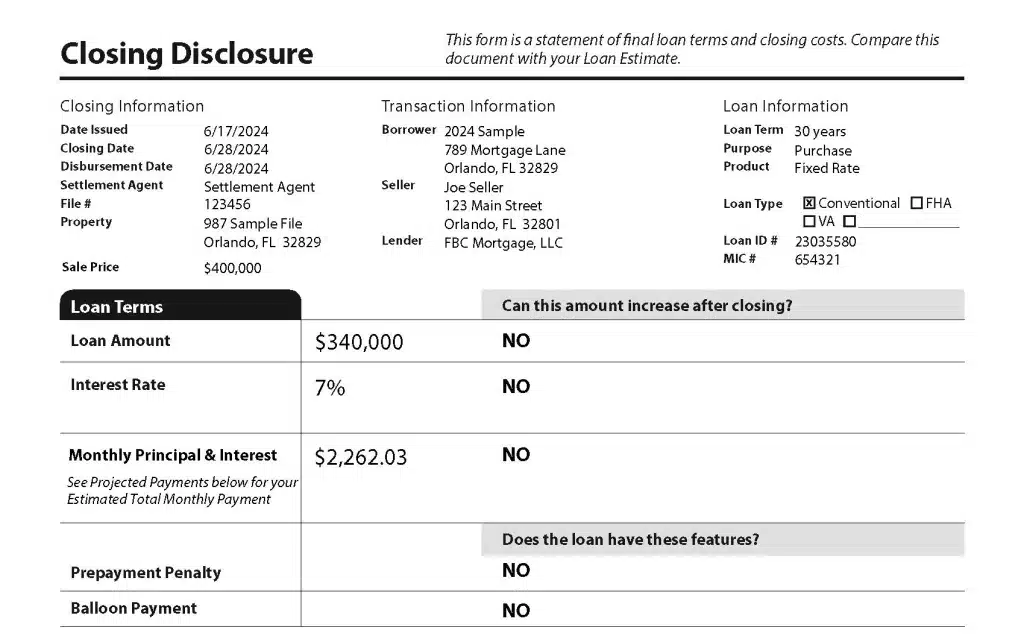

Also: lenders must provide your Closing Disclosure at least three business days before closing, use those days to review everything and ask questions.

Title Company & Title Insurance in Ohio

In Ohio, title services often include the closing agent and the title work. The CFPB notes that title services include title search and title insurance, and that in many areas you can shop for them.

Owner’s title insurance protects you if someone later claims a right to the property from before you bought it (like unpaid taxes or contractor liens).

ALTA also explains the core purpose of title insurance as protecting property rights.

Title insurance isn’t glamorous. But it’s one of the most practical protections you buy.

The 3 Biggest Contract Mistakes Ohio Homebuyers Make

Let’s keep this real. These are the mistakes that cause panic later:

1) Writing financing terms you can’t actually meet

Trying to look “strong” can backfire. We write terms that are realistic, and competitive, without putting your earnest money at risk.

2) Waiving protections just to win

Yes, competition exists. But smart buyers win with strategy, not fear. Contingencies exist to protect you, especially your deposit.

3) Assuming appliances/items are included

If it’s not written, it’s not promised. Spell it out.

Don’t get emotionally finessed by a contract. Protect your money. Protect your peace.

Ohio buyers, don’t let a contract fumble cost you

Why This Matters in the Cincinnati Market (2026)

Cincinnati is still a market where good homes move, and buyers need to be prepared.

Recent market data shows Cincinnati homes have been taking longer to sell compared to last year in some periods, and pricing has shifted year over year (example: Redfin’s city trend reporting for late 2025).

Zillow’s Cincinnati housing market pages also indicate how quickly homes can go pending and provide updated market trend snapshots.

What this means for you as a buyer in 2026:

- You need a contract that’s clean and confident

- You need deadlines you can actually hit

- You need protections that match your risk tolerance

- You need someone local who can explain it fast and clearly when things move quickly

That’s my job. I’m not here to pressure you, I’m here to guide you.

FAQs — Ohio Real Estate Purchase Contracts

Is the Ohio purchase contract legally binding?

Yes. Once both parties sign, it becomes a binding agreement (with specific exit options based on contract terms).

Can I back out after signing?

Sometimes, usually through a valid contingency (financing, inspection, appraisal, HOA review), depending on what’s written and your deadlines.

What is earnest money, and can I lose it?

Earnest money is a good-faith deposit. You may risk it if you breach the contract, and contingencies help protect it.

Do I need a lawyer to buy a home in Ohio?

Many Ohio closings are handled via title/closing services; title services can include the closing agent who conducts closing.

What happens if the appraisal is low?

Often: renegotiate, bring cash, or exit, depending on your appraisal contingency language.

Should I skip the inspection to win?

I don’t recommend it. Inspection is one of your strongest protections.

What if the home is in an HOA?

Review HOA governing docs (rules, bylaws, restrictions) and financial health, these can affect your lifestyle and even loan approval.

What appliances stay with the house in Ohio?

Only what the contract says stays. If you want it, write it in.

When do I see my final closing numbers?

Your lender must provide a Closing Disclosure at least three business days before closing, use it to double-check everything.

Final Advice Before You Sign Anything

Here’s my final reminder: don’t let the contract intimidate you.

A strong buyer isn’t the one who signs fastest. A strong buyer is the one who signs with clarity.

If you’re reading this as a first-time buyer, especially if you’re a woman who has been talked over in financial conversations before, hear me: this is your purchase, your future, your money. You have every right to understand it fully.

Want a Calm, Clear Next Step?

If you’re buying in Cincinnati or anywhere in Ohio and you want someone to walk through your contract with you, calmly and clearly, I’m HERE.

And if you’re not ready to talk yet, but want a quick starting point, you can use my free home value tool to get an instant estimate: 👉 CLICK HERE

It’s a helpful first step. And when you’re ready for a real strategy (not just a number), I’ve got you.

📩 Thinking about buying or selling in Cincinnati?

Call or text me at (513) 289-1039,

or contact me here: deroussel.com/contact.

I’d love to help you discover what’s possible in your next move.

Thinking of selling your home? Start the conversation with Monika DeRoussel.