Buying your first home is exciting… and yes, it can feel like a lot.

Most first-time buyers start the same way: scrolling Zillow late at night, saving favorites, and wondering, “Is this even realistic for me?” I get it. That browsing phase is fun, but without a plan, it can also create stress fast, because you’re seeing homes before you know your true budget, your real monthly payment, or what it takes to actually win a house in today’s market.

And here’s the truth: your first home can shape your finances for years. It’s not just a purchase, it’s a foundation. That’s why I want you to feel calm, informed, and protected at every step.

If you want a visual walkthrough, in a related video, Monika Deroussel breaks this process down step by step for first-time buyers and explains what to focus on first (so you don’t waste time or fall in love with the wrong home). Use it alongside this guide as your “friendly roadmap.”

No pressure here, just a clear plan you can follow, one step at a time.

Step 1: Get Organized Before You Start Browsing

The #1 mistake first-time buyers make is starting with homes instead of starting with their life and their numbers.

Before you fall for pretty kitchens and dreamy backyards, pause and get organized. A home should fit your real world, your job stability, your monthly comfort zone, your commute, your future plans, and yes… your peace of mind.

Here’s what to clarify first:

- Work and income stability: Are you in a solid role? Any changes coming soon?

- Your “why”: Are you buying for stability, building equity, starting a family, being closer to work, or investing in your future?

- Your non-negotiables: Location (Cincinnati, Mason, West Chester, Indian Hill), school district needs, yard vs. low maintenance, etc.

- Your comfort payment: Not the max a lender approves, your sleep-at-night number.

Monika DeRoussel shares the most important first step before buying a home

Step 2: Talk to a Lender and Understand Your Financial Picture

This is the first “real” step, because once you understand your financial picture, everything gets easier.

A lender will help you look at the full story, including:

- Credit score (and what to improve)

- Debt-to-income ratio (DTI)

- Income documentation and stability

- What payment range makes sense for you

And let’s talk about real life: student loans, car loans, and credit cards. Many buyers assume student loans automatically ruin their chances, they don’t. What matters is how your overall monthly obligations compare to your income.

A smart lender can also help you decide what to pay down first (and what not to touch), because different debts affect your mortgage approval differently.

Also important: your credit score can impact your interest rate and monthly payment in a meaningful way, so even a focused improvement plan can be worth it.

Step 3: Pre-Approval, Monthly Payments & Real Numbers

Online estimates can be comforting… and wildly incomplete.

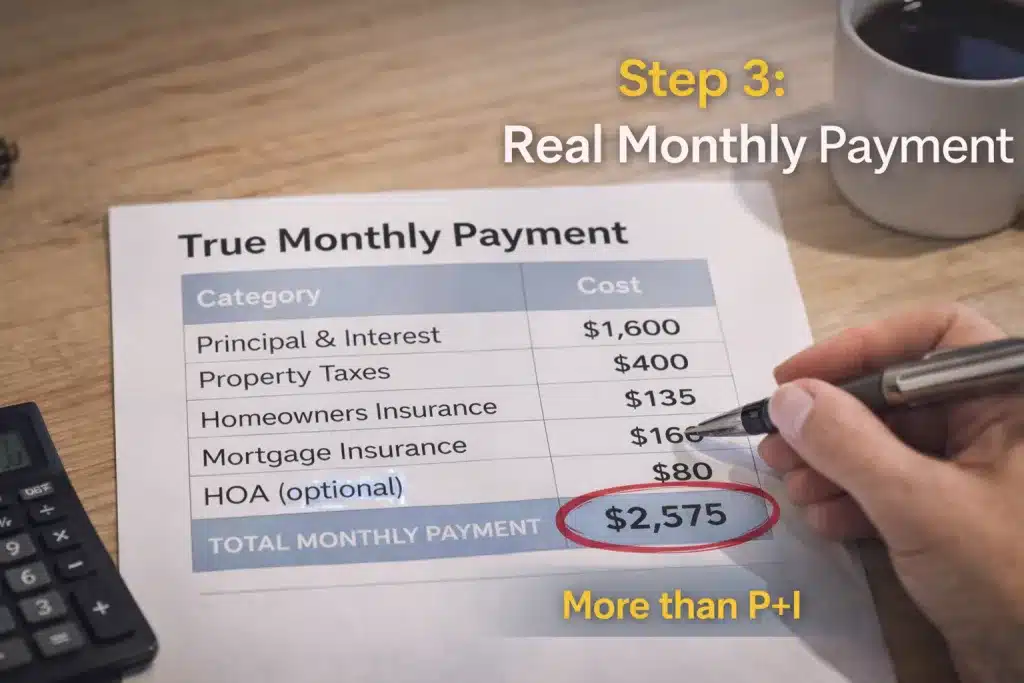

A real monthly payment is usually more than “principal + interest.” It often includes:

- Property taxes

- Homeowners insurance

- Mortgage insurance (if applicable)

- Sometimes HOA fees

- Possibly escrow payments (set aside monthly for taxes/insurance)

- That’s why pre-approval matters. It’s not just a letter, it’s a reality check that helps you shop confidently and make strong offers.

Also, lenders are required to provide a Closing Disclosure before closing (typically three business days), so you can review your final numbers and ask questions before you sign.

Your mortgage isn’t just principal and interest.

Step 4: Down Payment Myths & First-Time Buyer Grants

You do not need 20% down to buy your first home.

Many first-time buyers buy with 3% down (conventional) or 3.5% down (FHA), depending on the program and their situation.

Here are common paths buyers use:

- Conventional 3% down programs (great for many first-timers)

- FHA 3.5% down (often more flexible for some credit profiles)

- VA loans (often no down payment for eligible buyers, when conditions are met)

- USDA loans (can be “no money down” for eligible rural areas/income limits)

For Ohio buyers, there are also down payment assistance options through the Ohio Housing Finance Agency (OHFA) that may help with down payment and/or closing costs for qualified buyers. Program rules can change, so we always verify eligibility and current terms before you plan around it.

it’s not about having perfect numbers, it’s about positioning you to win smartly 😉.

Step 5: Get Access to Homes Before They Hit Public Sites

Zillow and Realtor sites are great for browsing, but they’re not always the fastest or most accurate for what’s truly available right now.

That’s why I set buyers up with a custom buyer portal connected to the local MLS feed. It can help you:

- See new listings faster

- Catch “coming soon” opportunities when available

- Filter by what actually matters (payment range, location, layout, school district, etc.)

- Move quickly, without rushing blindly

This matters in competitive areas like Mason or West Chester where the best homes can get attention quickly.

Skip the Zillow chaos. Get access to Monika´s buyer portal with up-to-date listings

Step 6: Touring Homes & Choosing the Right One

Photos can be… very convincing. And sometimes very misleading.

Touring in person helps you catch things no listing can show:

- Noise level (street traffic, neighbors, schools nearby)

- Natural light (bright vs. dark rooms)

- Smells, humidity, maintenance signals

- Layout flow (especially if you work from home or have kids)

- The “feel” of the street, something buyers decide within seconds

My job here is to help you slow down just enough to make a confident decision, without losing the house to hesitation.

Step 7: Purchase Contract, Earnest Money & Inspections

Once you’re ready, your offer includes a purchase contract, and yes, it’s legally binding. This is where strong guidance matters.

A few terms you’ll hear:

- Earnest money: A good-faith deposit that shows you’re serious (amount varies by price point and market).

- Home inspection: A professional inspection that helps you understand the home’s condition and avoid expensive surprises.

- Negotiation: After inspection, you may request repairs, credits, or adjustments depending on what we find.

One of my favorite questions after inspection is simple:

“Knowing what I know now… do I still want this home?”

That’s how we protect you from regret.

Step 8: Appraisal, Title & Protecting Your Investment

Two big protections happen here:

1) Appraisal

The appraisal helps confirm the home value supports the price, especially for the lender. It’s designed to prevent overpaying beyond what the market supports.

2) Title work + title insurance

A title search checks for ownership issues, liens, or legal claims that could cause problems later.

You’ll often hear two types of title insurance:

- Lender’s policy protects the lender

- Owner’s policy protects you (your ownership rights)

This difference matters, because protecting your investment means protecting your rights, not just the bank’s.

Step 9: Final Walkthrough, Closing & Getting the Keys

You’re almost there.

Before closing, you’ll do a final walkthrough to confirm:

- The home is in the expected condition

- Repairs (if agreed) were completed

- Nothing changed since your last visit

On closing day:

- You’ll sign your final paperwork

- Funds are transferred (wire safety matters, always confirm instructions directly with trusted contacts)

- The transaction records

- And then… keys. 🎉

It’s official, you’re a homeowner. Monika DeRoussel celebrates closing day with keys in hand, ready to welcome first-time buyers into their new chapter.

Common First-Time Buyer Mistakes (and How to Avoid Them)

-

Starting without talking to a lender

→ Fix: Get pre-approved early so you shop with confidence. -

Focusing on the price instead of the payment

→ Fix: Always estimate monthly payment with taxes/insurance, not just the mortgage. -

Skipping or minimizing the inspection

→ Fix: Use inspection to make a clear, informed decision (not an emotional one). -

Falling in love too fast

→ Fix: Love the home after the numbers and condition make sense. -

Letting fear rush you

→ Fix: A good plan helps you move fast without making risky choices.

FAQs — First-Time Home Buying in 2026

How much money do I need upfront?

It depends on your loan type, down payment, and closing costs. Many buyers plan for down payment + closing costs + a small cushion for moving and first repairs.

Do I really need 20% down?

No. Many buyers use low down payment options like 3% (conventional) or 3.5% (FHA).

Can I buy with student loans?

Yes. Student loans don’t automatically disqualify you. A lender will look at your monthly obligations and overall financial picture.

What’s the difference between pre-qualification and pre-approval?

Pre-qualification is an estimate. Pre-approval is a stronger review of your finances and is taken more seriously by sellers.

How long does the first home buying process take?

A common range is 30–45 days from contract to closing, but it can vary based on lender timelines, inspections, appraisal, and title work.

Is buying better than renting in 2026?

It depends on your timeline, payment comfort, and goals. Buying can build equity, but only if the monthly payment fits your life and you plan to stay long enough.

What credit score do I need?

It varies by loan type and lender. Improving your credit can help your rate and your monthly payment.

Are there first-time buyer programs in Ohio?

Yes, Ohio has programs such as OHFA down payment assistance for qualified buyers, with specific rules that can change by year.

What are the biggest costs people forget?

Property taxes, insurance, mortgage insurance, HOA fees, and moving/maintenance costs.

What is a Closing Disclosure and when do I get it?

It’s a final breakdown of your loan and closing costs, and lenders generally must provide it at least three business days before closing.

Let’s Take the Next Step Together

If you’re thinking about buying your first home and you want someone calm, honest, and experienced in your corner, I’d truly love to help.

Whether you’re looking in Cincinnati, Mason, West Chester, Indian Hill, or nearby, my goal is to help you feel clear on your next step, confident in your numbers, and protected throughout the process.

And if you’re not ready to talk yet, but want a quick starting point, you can use my free home value tool here to get an instant estimate: 👉 CLICK HERE

It’s a helpful first step, and when you’re ready for a real strategy (not just a number), I’m here.

📩 Thinking about buying or selling in Cincinnati?

Call or text me at (513) 289-1039,

or contact me here: deroussel.com/contact.

I’d love to help you discover what’s possible in your next move.

Thinking of selling your home? Start the conversation with Monika DeRoussel.